“Fintech has allowed us to be resilient. Even with branch closures and disruptions, we have ensured that our customers can bank from home,” says Luanne Lim, CEO of HSBC in Hong Kong.

“This is all due to the investment we have made in digital. More than 90 percent of our wealth management transactions already occur through digital channels.

“Globally, as a bank, we invested US$6.1 billion in digital and technology development last year. In 2022, we released on average more than one digital feature enhancement every day for our wealth management, personal banking and commercial banking clients in Hong Kong.

The wisdom of making these investments during the pandemic continues to pay off today, both for the bank and its customers. This adoption has been very successful, and those considering moving to Hong Kong can open an account in just 10 minutes via their mobile phone before arrival.

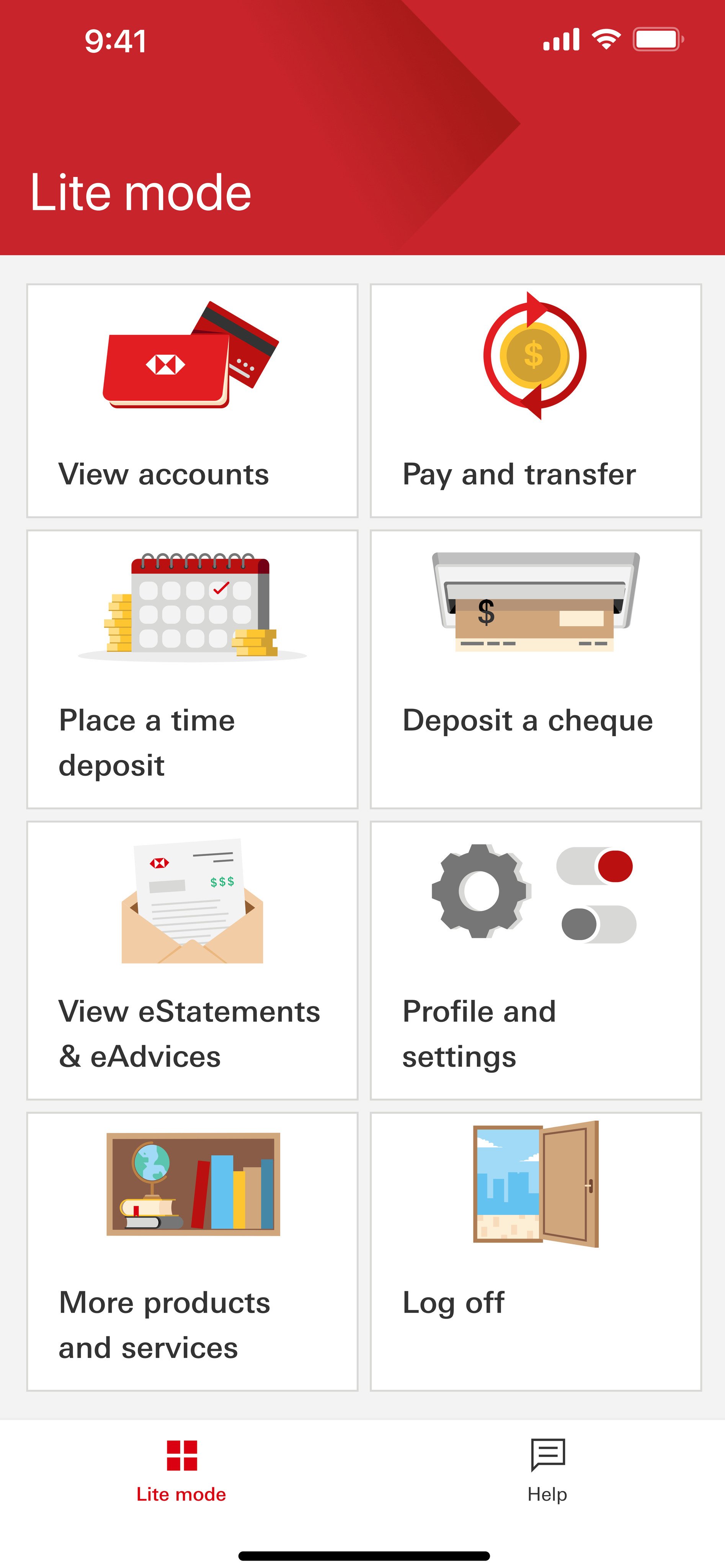

Lim highlights the high adoption rates of the bank’s digital channels, as demonstrated by the HSBC Mobile app’s more than 2 million active users. The app has a host of features, including free money transfers to HSBC and other bank accounts in over 50 countries and territories, as well as tracking top-performing business ideas.

In the back office, HSBC has a long history of using technology, including artificial intelligence (AI), to support customer service, streamline operations and detect financial crimes.

“AI has been around for a long time. What has changed in recent years is the emergence of generative AI,” says Lim.

She cites customer service chatbots as an example, where instead of having pre-programmed canned responses, the virtual assistant, enabled by generative AI, can learn about a customer’s own needs.

“It will be like you are talking to a human; It’s going to be very personalized. This will one day be a game changer in how we interact with our customers,” she says.

However, Lim says such technology will not completely replace in-person services and will also need to be overseen by proper governance and risk management, with the necessary tools. “There’s a fiduciary duty here, and it’s on the bank.”

For corporate clients, HSBC is also enhancing its service offering through technology, particularly for small and medium-sized enterprises (SMEs), which Lim calls “the lifeblood of Hong Kong”.

“We launched Merchant Box, a digital solution for SMEs to simplify payments on e-commerce platforms, as well as an integrated B2B (business-to-business) financing tool allowing corporate customers to offer extended payments,” she said. .

The bank has also participated in industry-wide initiatives aimed at achieving financial inclusion, including the Hong Kong Monetary Authority’s (HKMA) Trade Data Exchange (CDI).

CDI was billed as “a next-generation financial data infrastructure” to enable more efficient financial intermediation in the banking system by introducing a single connection point for secure, efficient and scalable sharing. The aim is to facilitate the credit assessment process for SME loans.

Another development that could benefit SMEs in the future is the use of digital currencies. For example, under the HKMA’s retail e-HKD pilot program, HSBC partnered with the School of Business and Management at the Hong Kong University of Science and Technology to conduct an exercise in mid-September , during which approximately 200 students received 100 hypothetical e-HKDs. HKD tokens to spend at five on-campus merchants over a one-week period.

“Insights from this closed-loop pilot provide a first picture of the benefits that a central bank digital currency (CBDC) ecosystem could potentially bring in everyday payments,” Lim said. “Our distributed ledger technology enabled near-instantaneous transfer of value from the customer’s wallet to the merchant’s, as well as automated rewards and discounts through the programmability of smart contracts.”

She adds that while the trial results will serve as a basis for future retail digital currency experiments, the business case for a wholesale digital currency is already clear.

Hong Kong is at the forefront of the international development of wholesale CBDCs. Between August 15 and September 23 last year, 20 commercial banks from Hong Kong (including HSBC), mainland China, the United Arab Emirates and Thailand carried out transactions worth US$22 million on behalf of their corporate clients using CBDCs issued on a shared platform. by their respective central banks.

The initiative, called mBridge, enables rapid business transactions, so that business-to-business payments can be settled in seconds – securely and cost-effectively.

HSBC is a strong supporter of Hong Kong’s startup ecosystem, home to some 800 fintech companies. In addition to sponsoring various pitch programs that offer start-ups the opportunity to obtain seed capital and meet venture capitalists, the bank’s $3 billion HSBC New Economy Fund offers businesses innovative, fast-growing Hong Kong and mainland China tailor-made debt solutions. from Series A funding.

Developing future talent is another important factor underpinning the bank’s strategy in supporting fintech, says Lim. HSBC works with several universities to host competitions for post-secondary students to showcase their ideas, while providing training and networking opportunities that prepare them for careers in fintech.

It all boils down to one goal: ensuring the healthy development of financial services.

“As a bank, we use the services of fintech companies. They give us capabilities in a very agile way,” says Lim.

“When Fintech start-ups emerged, people said banks should be afraid. Today we are at a point where we love each other. It’s a wonderful marriage,” she concludes.

Luanne Lim is among more than 500 notable speakers at this year’s Hong Kong FinTech Week, which runs until November 5 and attracts more than 30,000 attendees from some 95 countries and territories.