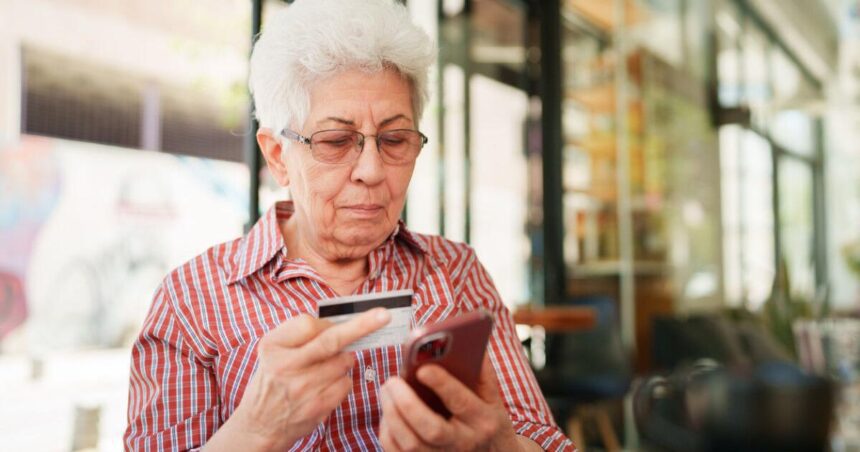

Financial scams against seniors are on the rise, with suspected fraud against the elderly having increased by almost 50% in 2023, according to Thomson Reuters data (and 2022 was already a record year, up 50% compared to 2021). It is more important than ever to protect seniors from these innovative fraudsters.

To learn more about widespread scams targeting seniors and how to protect our loved ones, we spoke with three cybersecurity and fraud experts. Here are the top financial scams and elder fraud tactics to be aware of, according to experts.

The Atlanta Hawks and State Farm teamed up for their second annual Opening Night pep rally at the Coan Park Recreation Center on Thursday. Youth enjoyed interactive stations including basketball drills, a meet-and-greet opportunity with Hawks players and performances from Hawks Entertainment. Click for more information.PHOTOS: Atlanta Hawks Opening Night Pep Rally

The #1 Senior Financial Scam, According to Cybersecurity Experts

Popular Stories Right now

Many scammers are taking advantage of seniors’ lack of technological knowledge, says cybersecurity expert Josh Amishavfounder and CEO of Meaning of violationa company that monitors the dark web, private hacker forums, and criminal marketplaces for data breaches.

“From our perspective, the main scam targeting seniors is tech support scams“hackers claiming the victim has a virus on the device and asking for money to repair it,” Amishav says.

In this scam, hackers call or send pop-up messages claiming that the victim’s device is infected. They then offer to “fix” the nonexistent problem for a fee.

Dori Buckethalvice president of risk and fraud solutions at Thomson Reuters, confirms that criminals are using this tactic aggressively. “Be wary of any phone calls that say they are calling to “verify” your personal information, such as your bank accounts, credit card numbers, social security number, mailing address, etc.”

By exploiting fears about viruses, fraudsters gain remote access to steal personal data and charge for unnecessary services.

5 Most Common Scams to Watch Out for

Tech support scams may be considered the most common, but that’s not where elder fraud stops. Here are five other senior-related scams that experts want you to know about.

A “grandparent scam” that plays on emotions

Amishav points out another troubling trend: the “grandparent scam” where impostors pose as loved ones in immediate distress.

“Scammers pose as a grandchild in distress and ask for money to be sent urgently,” warns Amishav.

Dr. Brian Callahangraduate program director for the Information Technology and Web Sciences Program and director of the Rensselaer Cybersecurity Collaboratory at Rensselaer Polytechnic Institutestates that scammers often call the victim pretending to be a grandchild, niece or nephew and adds that “the scammer may claim that they are in a distant country and do not have access to the usual methods of obtaining money.

This scam touches the hearts of grandparents, exploiting their deepest concern for their family to trick them into transferring money immediately and without verification.

Social Security scams run wild

There are also Social Security card scams, which Callahan said are commonplace these days. “The victim is called and informed that their social security number was identified in a crime that was committed and that the police are about to arrest them unless a certain amount of money can be paid,” he said.

Callahan shares that scammers can cite anything from tax evasion to drug dealing as the crime the senior is “accused of.”

Lonely elderly people trapped in romance scams

According to Amishav, romance scams are also increasing on dating sites.

“Romance scams (are where) perpetrators exploit dating sites to develop relationships with older people and possibly ask for money,” he explains.

These fraudsters build emotional connections before constructing elaborate stories to extort funds. Isolated older people long for companionship and connection, which scammers are ruthlessly preying on.

False invoices for health services

Amishav notes an increase in health care and Medicare inconveniences. “Scammers pose as Medicare representatives, ask for personal information, provide false services and then charge,” he says.

Posing as Medicare representatives or health care providers, scammers use telephone, email, text and mail to steal money and identities from seniors under the guise of “verifying” information. information or provide essential services. They exploit fears about access to health care to perpetrate these insidious scams.

Dishonest contractors target homeowners

Another common scam, according to Amishav, is home renovation scams. “Scammers pose as local contractors offering home improvement services, but they either take money and run or do shoddy work,” he says.

There has also been an increase in home improvement scams, in which “contractors” offer seniors unnecessary and overpriced repairs or improvements to their homes. These programs work by pressuring older people to make immediate repairs before they have time to think.

How to protect our loved ones

To avoid these predatory traps, experts offer advice:

Educate about the possibilities

“Regularly inform yourself about common scams: this is the first line of defense,” emphasizes Amishav. Have frequent conversations to raise awareness before victimization occurs.

Callahan agrees, adding, “Periodic conversations about how no real police will ever call you to tell you your Social Security number was used in a crime can really help.” »

Check in regularly

Maintain regular check-ins by phone or in person to anticipate any suspicious communications, Amishav recommends. Look for the warning signs.

Teaching technological intelligence

Raise the digital literacy level of the older people around you. “These scams rely on the fact that many older people are not as tech savvy as younger generations,” Callahan says. “You are much less likely to fall for a pop-up telling you that you need to call a number to remove a virus from your computer.”

Review software and manage payments

Teach your loved ones about antivirus software. “Explain to them that antivirus software never asks you to call them,” says Callahan. “Many antivirus software, like that built into Microsoft Windows, is already free so there is never a need to pay. If you opt for a paid antivirus plan, set up automatic billing if it’s a subscription or handle payment yourself instead of letting your elderly loved one take care of it.

Help with password security

With this in mind, encourage password managers and two-factor authentication, Amishav adds. This prevents criminals from accessing personal information online.

Monitor financial statements for questionable transactions, Amishav says. Watch for strange transfers to unknown entities.

Block calls

Limit robocalls by signing up for the Do Not Call registry, advises Amishav. Also use call blocking services to reduce risks.

The consensus is that education and vigilance are key to protecting older adults from these insidious and increasingly common scams. By regularly discussing scam awareness and tactics, we can empower seniors to identify and avoid fraud when it occurs. Proactive defense is essential to prevent elder financial abuse, which is urgently escalating. With compassion and diligence, we can help protect the seniors we love.

Sources